Is Gastric Bypass Right for You? Eligibility & Benefits Explained

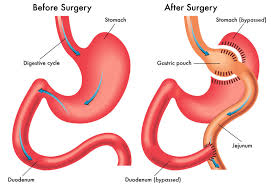

Gastric bypass attracts attention from people who want a structured and medically guided way to lose weight. Many individuals explore this option after trying diet changes, activity plans, and supervised programmes without lasting results. The procedure supports long-term weight management by combining reduced food intake with improved metabolic response. People considering Laparoscopic gastric bypass in … Read more