Gold loans have emerged as one of the most preferred financial instruments in India, thanks to their convenient application process, competitive interest rates, and minimal documentation. For those who are unaware, a gold loan is essentially a secured loan where you pledge your gold ornaments or assets as collateral in exchange for funds. With numerous financial institutions and non-banking financial companies (NBFCs) offering gold loans, the competition has driven down interest rates significantly, benefiting borrowers. Among the many delicate nuances of the financial ecosystem, carnival deals by lenders provide an additional edge, bringing forward lower interest rates, lenient gold loan documents requirements, and exclusive offers on these loans.

This article dives deep into how carnival deals and the underlying strategies of financial institutions throw light on “gold loan less interest rate” insights. It also covers the essential aspects such as gold loan documents and factors influencing the rates offered to borrowers. In today’s dynamic economic environment, understanding these key patterns can give you an upper hand while seeking a gold loan at favorable terms.

The Gold Loan Landscape in India – Ushering Affordable Borrowing

Gold has always held immense cultural and economic significance in India. Beyond its ornamental and investment value, gold has become a reliable financial resource for individuals in need of quick liquidity. Financial institutions, recognizing gold’s secured value, have tailored gold loan products to attract borrowers with an essential need for immediate funds.

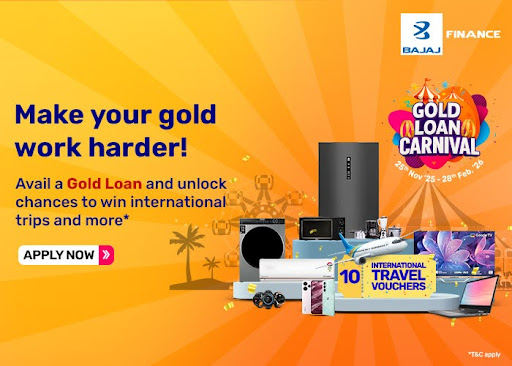

However, competition within the financial sector has led institutions to refine key elements of gold loans, including lower interest rates, reduced processing fees, and more attractive schemes. Enter carnival deals, which have become a game-changer in providing attractive gold loan less interest rates. These seasonal promotions provide borrowers with favorable borrowing terms such as reduced interest rates and exciting benefits, ensuring affordability while meeting their cash requirements.

Carnival Deals – Breaking Down Gold Loan Less Interest Rates

Seasonal carnivals or festive offers by banks and NBFCs are promotional events aimed at attracting borrowers during high-demand periods like festivals, weddings, or major shopping events. These deals often include discounts on services or products, making financial instruments such as gold loans more appealing to customers.

Why Carnival Deals Stand Out

- Reduced Interest Rates:

One of the prime attractions in carnival deals is the discounted interest rates offered by lenders. With gold loan less interest rates during such times, borrowers can secure liquidity without the heavy burden of repayment costs. For instance, while typical gold loan interest rates range between 7% and 14% per annum, lenders may offer carnival deals where rates drop to as low as 6.5%. These reduced rates can significantly lower the borrower’s financial stress in the long run. - Flexible Loan Tenures:

Carnival offers often come with an added benefit of allowing longer loan tenures at affordable repayment terms. This allows borrowers to manage their financial obligations without the need for hefty EMIs. - Zero or Minimal Processing Fees:

Many carnival deals waive off processing fees entirely or bring them down to a negligible amount, making gold loans even cheaper. You essentially borrow against your gold assets without additional upfront charges. - Low Valuation or Additional Benefits:

Beyond “gold loan less interest rates,” carnival deals may also highlight higher loan-to-value (LTV) ratios or extra perks like insurance coverage for pledged gold and cashback offers.

Gold Loan Less Interest Rates During Seasonal Promotions – What Drives Them?

To understand what drives carnival deals offering less interest rates on gold loans, it’s important to explore the dynamics behind these financial instruments:

- Increasing Loan Volumes:

Lenders use carnival deals as a strategic move to increase their disbursal numbers. By reducing interest rates, they attract a greater volume of customers looking for short-term liquidity solutions. A higher customer acquisition rate offsets the reduced profit margins from less interest rates. - Tapping into Festive Financial Needs:

Festivities in India often come with significant financial commitments. Be it weddings, home renovations, or festive shopping, consumers require additional cash around these times. By offering discounted loans, lenders position themselves as primary sources for hassle-free credit. - Reduced Risk Factor:

Gold loans are secured loans, meaning the financial institution holds valuable collateral (gold) that can be easily liquidated in case of default. This reduces the lender’s risk profile, making it viable to offer competitive rates during carnival promotions.

Understanding these driving factors can guide borrowers when deciding on the right time to take advantage of these gold loan less interest rate deals.

Gold Loan Documents – A Hassle-Free Application Process

One of the most attractive features of gold loans—aside from their low-interest rates—is the minimal gold loan documents required for processing. Unlike other forms of loans such as personal loans or home loans, gold loans demand a limited stack of documents, ensuring instant and hassle-free financing.

Commonly Required Documents

- Identity Proof:

Documents such as Aadhaar Card, PAN Card, or voter ID card are typically required to verify your identity while applying for a gold loan. - Address Proof:

Lenders may request an address proof like a utility bill, driving license, or passport to ensure that your details are accurate and meet compliance requirements. - Photographs:

Passport-size photos are often needed during the loan application process. - Proof of Ownership of Gold:

Though not always required, some financial institutions may ask for proof of ownership of the gold ornaments being pledged to ensure credibility.

The application process is quick, and with carnival offers, lenders often extend doorstep services or relax a few document requirements, further simplifying the procedure.

Benefits of Choosing Gold Loans During Carnival Offers

Apart from the evident advantage of getting a gold loan less interest rate, opting for offers during carnival seasons comes with several complementary benefits:

- Instant Processing:

Carnival schemes often come with faster approvals and disbursements due to streamlined processes. Borrowers can typically receive funds within a few hours. - Transparency:

Lenders are particularly keen on offering transparent terms and conditions during seasonal deals, ensuring no hidden charges. - High Loan-to-Value Ratio:

During carnival promotions, financial institutions often provide higher LTV ratios, allowing you to borrow a larger percentage of your gold’s value. - Reward Programs:

As an additional incentive, lenders often pair carnival offers with reward programs. Borrowers may stand a chance to win prizes or cashback during these events.

Who Can Benefit the Most From Gold Loan Less Interest Rate Insights?

While pretty much anyone needing quick liquidity can benefit from carnival offers on gold loans, some specific use cases stand out:

- Small Businesses:

Entrepreneurs often require immediate funding to manage working capital or invest in resourceful opportunities. Carnival schemes help small business owners secure cost-effective loans with flexible repayment options. - Home Renovation Projects:

Gold loans, with minimal documentation and lower interest rates, are ideal for individuals looking to renovate their homes during festive seasons. - Educational Expenses:

Students aspiring to study abroad or individuals seeking to invest in higher education courses can leverage these low-interest gold loans for funding. - Farmers:

Many farmers pledge gold assets during harvesting seasons to meet their immediate financial obligations.

Conclusion

Gold loan carnival deals are a win-win scenario for both lenders and borrowers. Borrowers enjoy favorable conditions such as lower interest rates, relaxed documentation, and exclusive offers, while lenders increase their customer acquisition and market share. By taking advantage of these promotional events, one can significantly reduce their borrowing costs and manage liquidity requirements at affordable terms.

Whether you’re a small business owner, homemaker, or a student, understanding the nuances of gold loans can help you make informed financial decisions. As these seasonal schemes continue to rise in popularity, keeping an eye out for such deals can open doors to economical borrowing solutions during times of need.

Remember, while chasing gold loan less interest rates, always ensure you meet the minimal gold loan documents requirements and carefully evaluate the lender’s terms and conditions. A savvy borrower can easily turn carnival offers into long-term financial savings while meeting immediate financial goals.

By wisely utilizing the unique advantages of carnival offers, you can unlock the true potential of gold loans and empower your financial future.